What If You Are Not Like Steve Jobs?

What If You Are Not Like Steve Jobs?

Some days back I started reading Walter Isaacson‘s “Steve Jobs” all over again. Chapter fifteen, titled “The Launch” is about the launch of the first Macintosh in 1984, and ends with the following sentences:

…neither Raskin nor Wozniak nor Sculley nor anyone else at the company could have pulled off the creation of the Macintosh. Nor would it likely have emerged from focus groups and committees. On the day he unveiled the Macintosh, a reporter from Popular Science asked Jobs what type of market research he had done. Jobs responded by scoffing, “Did Alexander Graham Bell do any market research before he invented the telephone?”

I paused here, and thought:

Where does market research fit in when you have a CEO with a strong intuition and gut feel?

Jobs is famous for eschewing market research because he believed that it only yielded needs, wants, preferences of yesterday and not tomorrow. “It’s not the consumer’s job to know what they want”, he is known to have said when asked about market research for the iPad. And Jobs is hardly alone in this regard. Henry Ford is known to have said “If I had asked people how they could go faster from point A to point B, they would asked for more horses”. But for all the mavericks, you also come across many a quote about how important it is to know what customers want, such as this one from Sam Walton, no less an entrepreneur himself: “Focus on what the customer wants, and then deliver it”. To some extent, they reflect the differences in philosophies, strategies, positioning and target markets. While Walmart is about delighting customers with “Always Low Prices”, Apple is about delighting customers with products that they are willing to pay a premium for.

Interestingly, I came across an article in Economy Watch, which cited a 2011 survey done by the MIT Sloan School of Business.

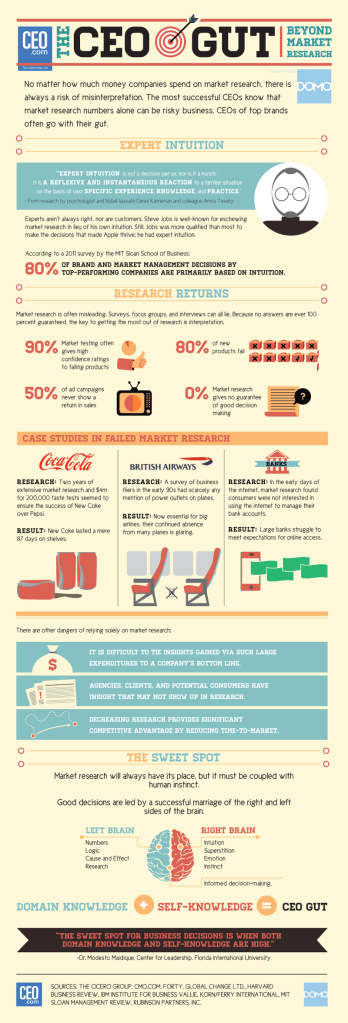

According to a 2011 survey by the MIT Sloan School of Business, nearly 80 percent of all brand and market management decisions made by top-performing companies were primarily based on their CEO’s intuition, rather than any form of market research.

Below is the infographic that explains this survey (click to enlarge), with a conclusion: Market research will always have its place, but it must be coupled with human instinct.

…neither Raskin nor Wozniak nor Sculley nor anyone else at the company could have pulled off the creation of the Macintosh. Nor would it likely have emerged from focus groups and committees. On the day he unveiled the Macintosh, a reporter from Popular Science asked Jobs what type of market research he had done. Jobs responded by scoffing, “Did Alexander Graham Bell do any market research before he invented the telephone?”

I paused here, and thought:

Where does market research fit in when you have a CEO with a strong intuition and gut feel?

Jobs is famous for eschewing market research because he believed that it only yielded needs, wants, preferences of yesterday and not tomorrow. “It’s not the consumer’s job to know what they want”, he is known to have said when asked about market research for the iPad. And Jobs is hardly alone in this regard. Henry Ford is known to have said “If I had asked people how they could go faster from point A to point B, they would asked for more horses”. But for all the mavericks, you also come across many a quote about how important it is to know what customers want, such as this one from Sam Walton, no less an entrepreneur himself: “Focus on what the customer wants, and then deliver it”. To some extent, they reflect the differences in philosophies, strategies, positioning and target markets. While Walmart is about delighting customers with “Always Low Prices”, Apple is about delighting customers with products that they are willing to pay a premium for.

Interestingly, I came across an article in Economy Watch, which cited a 2011 survey done by the MIT Sloan School of Business.

According to a 2011 survey by the MIT Sloan School of Business, nearly 80 percent of all brand and market management decisions made by top-performing companies were primarily based on their CEO’s intuition, rather than any form of market research.

Below is the infographic that explains this survey (click to enlarge), with a conclusion: Market research will always have its place, but it must be coupled with human instinct.

So, when we read, “Market research will always have it’s place”, what does that mean? Can we strike a balance between driving forward with intuition and knowing when, how much, and what market research to do, especially if you are not like Steve Jobs?

WHEN

Very few products that get launched create entirely new categories in the market. Most products are evolutionary, better, faster, cheaper version of something that already exists in the market. For revolutionary new products, like the automobile, the telephone, an intuitive gut feel (defined in the infographic as Domain Knowledge + Self Knowledge) is likely to be more insightful than exhaustive market research. (It can be debated whether the iPod, iPhone, iPad are truly revolutionary products, as music players, smart phones and tablet computers had existed before, but the experience that Apple created was revolutionary. This can be the topic of an entirely separate post in itself).

Given that 80% of all new products fail, and if they were all driven by a visionary’s instinct, it is not clear if market research would reduce this number. Even the Macintosh was not successful initially, one of the factors that led to Jobs getting the boot. It is hard to say whether market research, rather than Steve’s intuition, could have saved the day for the Macintosh. But for most products, it is worthwhile to keep the ears closer to the ground.

Given that 80% of all new products fail, and if they were all driven by a visionary’s instinct, it is not clear if market research would reduce this number. Even the Macintosh was not successful initially, one of the factors that led to Jobs getting the boot. It is hard to say whether market research, rather than Steve’s intuition, could have saved the day for the Macintosh. But for most products, it is worthwhile to keep the ears closer to the ground.

HOW MUCH

This is a tricky one. How do we know if we have done everything we can to truly understand the market and customer need? Before we even embark on a market research project, we need to be clear about the goals of engaging in the exercise. What do we want to learn? is more important than What do we want to ask?. Many market research efforts tend to start with the latter and once all the truckloads of data is in, the effort to glean insights begins. So, it is important to ask the last question first.

Perhaps the people at Coca-Cola Company who did two years of exhaustive market research and conducted over 200,000 taste tests for New Coke fell into this trap. Through all these taste tests, they would have likely asked customers which tasted better, regular Coke or New Coke. And quite possibly, New Coke did taste better. But they failed to ask a critical question: Do you want a New Coke? As they say, a product launch is the most expensive form of market research!

Perhaps the people at Coca-Cola Company who did two years of exhaustive market research and conducted over 200,000 taste tests for New Coke fell into this trap. Through all these taste tests, they would have likely asked customers which tasted better, regular Coke or New Coke. And quite possibly, New Coke did taste better. But they failed to ask a critical question: Do you want a New Coke? As they say, a product launch is the most expensive form of market research!

WHAT

This is a tricky one. How do we know if we have done everything we can to truly understand the market and customer need? Before we even embark on a market research project, we need to be clear about the goals of engaging in the exercise. What do we want to learn? is more important than What do we want to ask?. Many market research efforts tend to start with the latter and once all the truckloads of data is in, the effort to glean insights begins. So, it is important to ask the last question first.

Perhaps the people at Coca-Cola Company who did two years of exhaustive market research and conducted over 200,000 taste tests for New Coke fell into this trap. Through all these taste tests, they would have likely asked customers which tasted better, regular Coke or New Coke. And quite possibly, New Coke did taste better. But they failed to ask a critical question: Do you want a New Coke? As they say, a product launch is the most expensive form of market research!

Perhaps the people at Coca-Cola Company who did two years of exhaustive market research and conducted over 200,000 taste tests for New Coke fell into this trap. Through all these taste tests, they would have likely asked customers which tasted better, regular Coke or New Coke. And quite possibly, New Coke did taste better. But they failed to ask a critical question: Do you want a New Coke? As they say, a product launch is the most expensive form of market research!

Facebook

Twitter

LinkedIn

Trending Posts

Tagged blogs