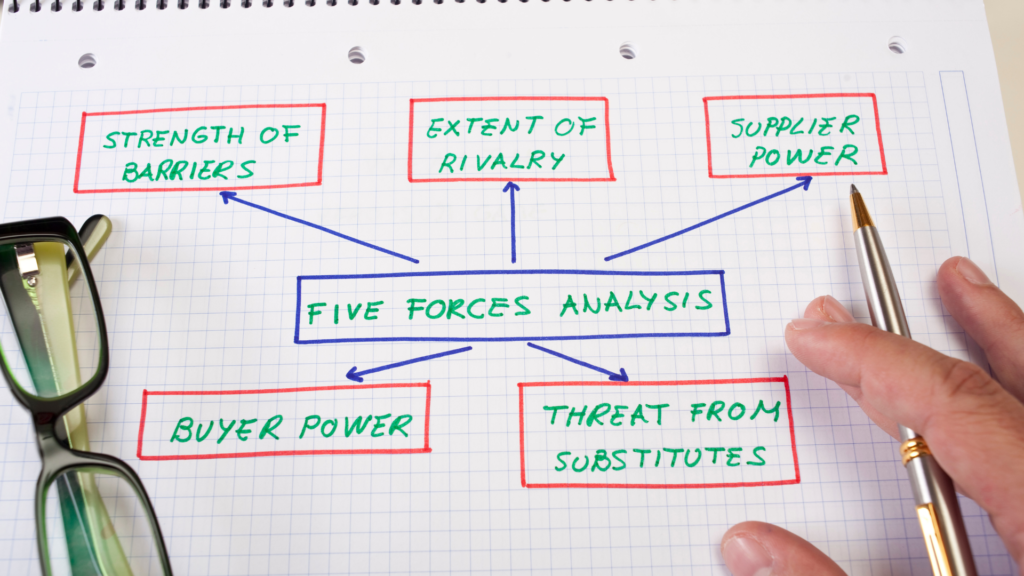

Five Forces Framework

Porter’s Five Forces framework helps us analyze the level of competition within a certain industry. It is useful to understand the root cause of profitability in an industry before we

Launch a new product

Enter a new industry sector

Need to refine/reconfigure the existing strategy

The combined strength of these forces aids us in gaining a strategic competitive edge and therefore determine the industry’s desirability.

Force 1 – The threat of substitutes

Companies in one industry are forced to compete with alternatives from other industries. Myself being a carbon footprint conscious citizen ,would say an electric car is a substitute for using oil in the dimension of energy. Before pre-pandemic times, using shared pool transit options such as Uber/Ola for work commute was a substitute for using a car. As substitutes’ price-performance alternative grows more appealing, it becomes increasingly difficult for these businesses to earn a profit.

Another example is the Game Zone in Indian shopping malls, which serve as a substitute for going to a multiplex theatre in the same mall to watch a movie. Our kid’s Influence the decision maker to the game zone; as job to be done(JTBD) in this case is spending quality time with family. Also an alternative of watching Netflix at home comes at a lower price.

The reasoning for substitute threats are

- The ability of customers to switch to a substitute product or alternative ways of fulfilling the needs. One good example is growing number of airports in tier 2 cities in India could also mean cheaper travel, which could hurt the auto and railway industries

- The possible threat of undesirability – If you’re addicted to Netflix after a pandemic, then is there a reason to drive to the movies and have to pay extra for parking and popcorn?

- The price-performance of substitutes is more attractive

Force 2 – The threat of new entrants

If a firm is profitable, it may be vulnerable to new entrants who will either imitate or develop a similar/better version of the product. This threat could curb the achievable profits.

The reasoning for new entrant threats are

- Barriers to entry: The lower the entry barrier, the greater the threat; in other words, markets with high entry barriers have few players and thus high-profit margins. When a food cart on a street gets popular, others begin to set up next to it, offering lower pricing and so reducing profits. Economic costs that entrants must pay that incumbents may not have to pay are known as entry barriers.New entrants have to figure out work around patents; exclusive or restrictive supplier or distribution agreements etc. Examples of industries with high entry barriers are Telecommunications, Energy, Pharma etc.

- Economies of scale: As a company grows in size, it’s scale goes up and it’s unit costs go down. A new entrant/aspirant must either invest heavily or tolerate a cost disadvantage. The lower the scale, the greater the threat to the incumbent.

- Power of incumbents: Networks, customer loyalty, and product distinctiveness are examples of incumbent power. I strongly advise you to consider these factors before moving forward with your product concepts.

Force 3 – Bargaining power of suppliers

Suppliers can impose bargaining power on industry players by raising prices or reducing the quality of purchased goods and services. As a result, suppliers can squeeze profit out of a sector that is unable to recover costs. Two notable examples are the semiconductor and aviation industries.

Suppliers are powerful when

- There are only a few suppliers to choose from

- The purchase is not large portion of suppliers sales

- No alternative suppliers/services to offer

Force 4 – Bargaining power of Buyers

Negotiations for a major multi-year supply contract of components by the large-size electronic behemoth could be a good example of bargaining power. We can use our bargaining power as customers by postponing the purchase for a long time or purchasing a used car.

Buyers and consumers bargaining power threats are:

- Buyer switching costs — Upgrading assets to create high-quality and/or high-performance outputs can incur switching costs for manufacturers. If it was decided not to perform such an upgrade because there is no viable returns, larger discounts need to be offered because purchasers will have better competitor options.

- Buyers are concentrated and are few. Very large retailers have an advantage over their suppliers.

- Identical/Undifferentiated Product – The given product/service is identical to others on the market. How many times have we not requested for a discount at a vegetable/farmers market? It is pretty normal for foodies who enjoy Indian chaats to request an extra sev (snack consisting of long, thin strands of gram flour, deep-fried and spiced). This could be a specialized product rather than a commodity, such as organic in the case of vegetables, hygienically made chaat adapted to your preferences, and so on.

Force 5 – Rivalry among existing competitors

Few industries are far more competitive than others, do we know why?

A good indicator of competitive rivalry is the concentration ratio of an industry. The lower this ratio is, the more intense its rivalry will be.

The reasoning for such a higher competitive rivalry is attributed to,

- Share number of competitors – Companies believe they can make competitive maneuvers without being observed in this situation. A gold marketplace strip exists in the town where I grew up, with all the gold jewelers having storefronts adjacent to each other. The customer is assailed by discounted offers, thereby cutting the competition as customers can easily select cheaper alternatives.

- Competitors are of equal size – When two or more companies are equal, they are more likely to engage in competitive battles, as well as attack and retaliate in their pursuit of market leadership. As an example in India, Uber and Ola , Zomato vs Swiggy.

- High fixed cost – High fixed costs put pressure on all businesses to fill capacity. Airlines, automobile manufacturers, and so on are good examples.

- High Storage cost – Push companies to decrease prices to move their goods

- Slow market growth –It is obvious that companies can only grow by stealing market share from one another.

- High stake – profitability vs expansion

- Exit barriers are high – This is when a company’s loyalty to a specific business keeps them competing despite earning low or even negative returns on their investment.

Strategy leaders have made few more additions to Porter’s five forces : “Complementors” and “Other Factors”. I’m referring to “Other Factors” as they have an impact on the five forces.

Force 6 – Complementors

Companies that sell complementary products or services sell items or provide services that are compatible with those in a certain industry. When a leisure customer travels by plane (airline industry), he or she is most likely going to a tourism-related destination and will use services like hotels and vehicle rental agencies. Another example is social media influencers to promote a brand or product. If complementors should be a separate force or a factor that influences these five forces is an expert discussion. To summarize, a customer would benefit from a combo product, such as a frankfurter and a bun.

Force 7 – Other Factors

Other factors not Forces to consider are

Technology and Innovation : Technology is rapidly growing , as example Shipper’s freight visibility offering provides up-to-the-minute information which improves coordination. Latest technologies are enhancing product performance and it is easier to boost a product’s information content.

Government : Government is a factor that can influence Porter’s five forces. Government policy can favor unions to raise Supplier force . Decision for increase in tariffs on raw material could dent the profit margins .

Industry growth rate : Biggest call-out is not to make a decision just based on the industry growth story . The presence of rapid growth may make it attractive to enter into the industry but it also means forces such as new entrants are high due to a low barrier , suppliers could be powerful etc.

If you want to start a new business or you have an established business with a new line of products; five forces framework will show the opportunities and threats associated with the choices you made.

Competition is not about beating rivals, it is about competing for wallet and/or mind share.

Want to know more about Michael Porter? Here is the link to his biography.

References

Harvard Business Review – How Competitive Forces Shape Strategy published by Michael E. Porter.

Inspired by the articles of The Strategic CFO.